Do You Report Rent Paid On Taxes . But depending on where you live, you might be able to deduct a portion of rent. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. when to report income. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. according to the iras, any rent payments you receive when you rent out your property are subject to income tax and must be. the rent that you receive from renting out your property in singapore may be subject to income tax. Income tax is a tax payable. taxpayers cannot deduct residential rent payments on your federal income taxes.

from londonmedarb.com

rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. the rent that you receive from renting out your property in singapore may be subject to income tax. when to report income. Income tax is a tax payable. taxpayers cannot deduct residential rent payments on your federal income taxes. can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. But depending on where you live, you might be able to deduct a portion of rent. according to the iras, any rent payments you receive when you rent out your property are subject to income tax and must be. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and.

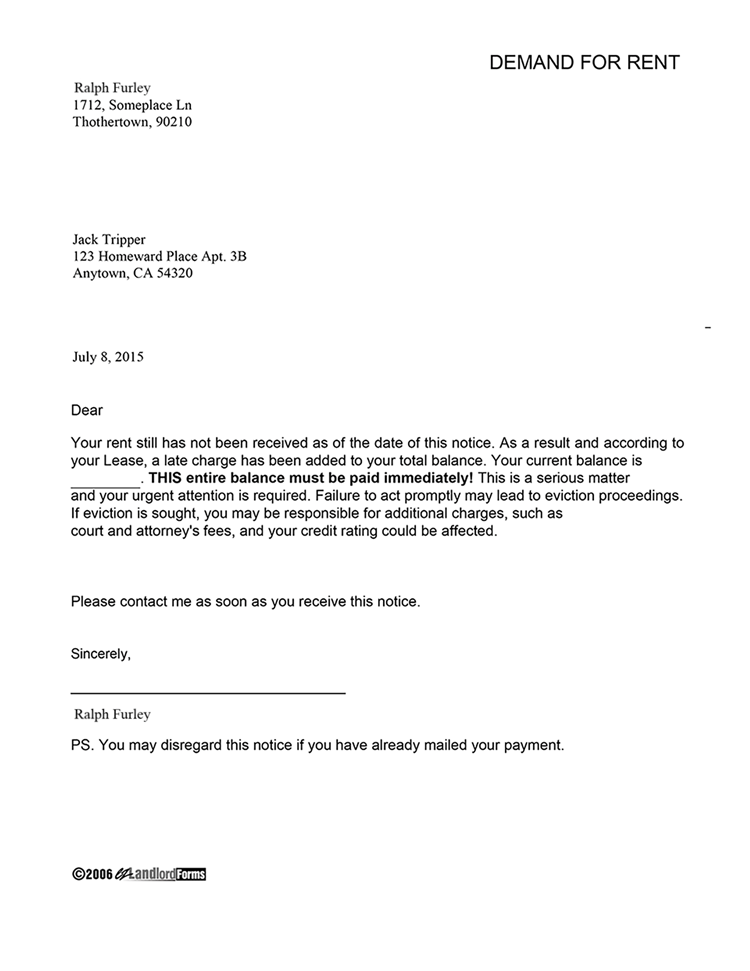

Notice Of Late Rent Free Printable Documents

Do You Report Rent Paid On Taxes when to report income. But depending on where you live, you might be able to deduct a portion of rent. Income tax is a tax payable. the rent that you receive from renting out your property in singapore may be subject to income tax. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. taxpayers cannot deduct residential rent payments on your federal income taxes. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. when to report income. can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. according to the iras, any rent payments you receive when you rent out your property are subject to income tax and must be.

From rvsbellanalytics.com

Journal entries for lease accounting Do You Report Rent Paid On Taxes can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. But depending on where you live, you might be able to deduct a portion of rent. taxpayers cannot deduct residential. Do You Report Rent Paid On Taxes.

From francoisewdamara.pages.dev

When Do We Get Our Taxes 2024 Melly Sonnnie Do You Report Rent Paid On Taxes Report rental income on your return for the year you actually or constructively receive it, if you are a cash. But depending on where you live, you might be able to deduct a portion of rent. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. tax residents in. Do You Report Rent Paid On Taxes.

From www.self.inc

How to Report Your Rent Payments to Credit Bureaus Self. Credit Builder. Do You Report Rent Paid On Taxes tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. when to report income. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. according to the iras, any rent payments you receive when you rent out. Do You Report Rent Paid On Taxes.

From pluspng.com

Collection of Rent Due PNG. PlusPNG Do You Report Rent Paid On Taxes taxpayers cannot deduct residential rent payments on your federal income taxes. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. the rent that you receive from renting out your property in singapore may be subject to income tax. rental income tax in singapore is accrued. Do You Report Rent Paid On Taxes.

From www.rentspree.com

Pay Rent & Increase Credit Score with RentSpree's Credit Builder Do You Report Rent Paid On Taxes can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. Income tax is a tax payable. taxpayers cannot deduct residential rent payments on your federal income taxes. according. Do You Report Rent Paid On Taxes.

From stophavingaboringlife.com

Paying Taxes 101 What Is an IRS Audit? Do You Report Rent Paid On Taxes Income tax is a tax payable. can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. taxpayers cannot deduct residential rent payments on your federal income taxes. when to. Do You Report Rent Paid On Taxes.

From rumble.com

IRS Form 8825 Reporting Rental and Expenses Do You Report Rent Paid On Taxes Income tax is a tax payable. when to report income. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. taxpayers cannot deduct residential rent payments on. Do You Report Rent Paid On Taxes.

From www.self.inc

How to Report Your Rent Payments to Credit Bureaus Self. Credit Builder. Do You Report Rent Paid On Taxes tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. according to the iras, any rent payments you receive when you rent out your property are subject to income tax and must be. But depending on where you live, you might be able to deduct a portion of. Do You Report Rent Paid On Taxes.

From londonmedarb.com

Notice Of Late Rent Free Printable Documents Do You Report Rent Paid On Taxes can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. But depending on where you live, you might be able to deduct a portion of rent. taxpayers cannot deduct residential rent payments on your federal income taxes. tax residents in singapore are required to declare their rental income to. Do You Report Rent Paid On Taxes.

From templatepdf.blogspot.com

Rent Receipt Template Pdf Download PDF Template Do You Report Rent Paid On Taxes taxpayers cannot deduct residential rent payments on your federal income taxes. when to report income. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. the rent that you receive from renting out your property in singapore may be subject to income tax. Income tax is a. Do You Report Rent Paid On Taxes.

From bestlettertemplate.com

Rent Payment Letter Template Format, Sample & Examples Do You Report Rent Paid On Taxes rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. Web. Do You Report Rent Paid On Taxes.

From www.formsbirds.com

2014 Renter's Certificate of Property Taxes Paid Arizona Free Download Do You Report Rent Paid On Taxes taxpayers cannot deduct residential rent payments on your federal income taxes. according to the iras, any rent payments you receive when you rent out your property are subject to income tax and must be. when to report income. But depending on where you live, you might be able to deduct a portion of rent. Income tax is. Do You Report Rent Paid On Taxes.

From templatelab.com

49 Printable Rent Receipts (Free Templates) ᐅ TemplateLab Do You Report Rent Paid On Taxes But depending on where you live, you might be able to deduct a portion of rent. when to report income. Report rental income on your return for the year you actually or constructively receive it, if you are a cash. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore. Do You Report Rent Paid On Taxes.

From www.chegg.com

Solved Exercise 166 (Algo) Temporary difference; tax Do You Report Rent Paid On Taxes taxpayers cannot deduct residential rent payments on your federal income taxes. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. according to the iras, any rent payments you receive when you rent out your property are subject to income tax and must be. when to report. Do You Report Rent Paid On Taxes.

From www.self.inc

How to Report Your Rent Payments to Credit Bureaus Self. Credit Builder. Do You Report Rent Paid On Taxes tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. taxpayers cannot deduct residential rent payments on your federal income taxes. rental income tax in singapore is accrued when you collect a monthly payment from the properties you rent out. But depending on where you live, you. Do You Report Rent Paid On Taxes.

From templatelab.com

49 Printable Rent Receipts (Free Templates) ᐅ TemplateLab Do You Report Rent Paid On Taxes the rent that you receive from renting out your property in singapore may be subject to income tax. tax residents in singapore are required to declare their rental income to the inland revenue authority of singapore (iras) and. when to report income. Income tax is a tax payable. Report rental income on your return for the year. Do You Report Rent Paid On Taxes.

From templates.rjuuc.edu.np

Excel Rental Payment Log Template Do You Report Rent Paid On Taxes can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. taxpayers cannot deduct residential rent payments on your federal income taxes. But depending on where you live, you might be able to deduct a portion of rent. Report rental income on your return for the year you actually or constructively. Do You Report Rent Paid On Taxes.

From printable.nifty.ai

Free Printable Rent Receipts Pdf PRINTABLE TEMPLATES Do You Report Rent Paid On Taxes when to report income. the rent that you receive from renting out your property in singapore may be subject to income tax. can employers use the actual rent paid instead of av of the property to report the accommodation benefits?. Income tax is a tax payable. rental income tax in singapore is accrued when you collect. Do You Report Rent Paid On Taxes.